The Australian Government is committed to introducing internationally-aligned mandatory climate related financial reporting beginning with large businesses and financial institutions. As part of this commitment the AASB has released its proposals for Australian equivalents of the International Sustainability Standards Board’s (ISSB) sustainability reporting standards.

What are the key proposals, who will they affect and when?

Background

In June 2023, the ISSB released its inaugural two sustainability standards – IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures.

The Australian Accounting Standards Board (AASB) issued Exposure Draft ED SR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information proposing Australian climate-related financial disclosures, using IFRS S1 and IFRS S2 as the baseline. The proposals would require an entity to disclose climate-related financial information as part of its annual report.

The AASB’s proposals would sit beside the Department of Treasury’s proposed roadmap for mandatory disclosure requirements by Australian companies. The AASB’s exposure draft is open for comment until 1 March 2024.

Structure of ED SR1

The AASB Exposure Draft incorporates three draft Australian Sustainability Reporting Standards (ASRS):

- ASRS 1 General Requirements for Disclosure of Climate-related Financial Information – based on IFRS S1 but limited to climate-related sustainability disclosures;

- ASRS 2 Climate-related Financial Disclosures – which is based on IFRS S2 but amended to reflect Australian circumstances; and

- ASRS 101 References in Australian Sustainability Reporting Standards – to incorporate any non-legislative documents that are referenced in ASRS.

Proposed differences to ISSB standards

ASRS are developed using the IFRS S1 and IFRS S2 as a baseline. However, the following key differences are proposed to International Sustainability Reporting Standards:

- Applicability of ASRS to not-for-profit entities: modifications and clarifications have been proposed to achieve sector neutrality and enhance the applicability of ASRS to not-for-profit entities, with a focus on considering climate-related risks and opportunities in the context of meeting the entity’s not-for-profit objectives.

- Narrowing sustainability disclosures to climate-related matters: ASRS 1 would deal exclusively with climate-related financial disclosures rather than broader sustainability topics contained in IFRS S1 and would replace ‘sustainability’ references in IFRS S1 with ‘climate’.

- Interim reporting: IFRS S1 includes optional reporting requirements for interim financial periods. The AASB proposes to omit that optionality. Whether this means that climate-related financial disclosures will be required in an interim financial report will be determined by the Treasury’s decisions regarding the application of ASRS.

- Climate scenario assessments: IFRS S2 requires an entity to use climate-related scenario analysis to assess its climate resilience. IFRS S2 does not specify the number of scenarios an entity is required to assess.

The AASB proposes that climate scenario assessments be made against at least two possible future states, one of which must be consistent with the most ambitious global temperature goal set out in the Climate Change Act 2022, which is “to limit the temperature increase to 1.5°C above pre-industrial levels”.

The AASB has not specified the upper-temperature scenario that an entity must use in its climate-related scenario analysis.

- Disclosure of Greenhouse Gases (GHG): entities will be required to disclose its absolute gross GHG emissions generated during the reporting period, expressed as metric tonnes of CO2 equivalent classified as Scope 1, Scope 2, and Scope 3 emissions by applying relevant methodologies set out in National Greenhouse and Energy Reporting Act 2007 (NGER) Scheme legislation, to the extent practicable. Detailed disclosures are also required of the measurement approach, inputs and assumptions the entity uses to measure its greenhouse gas emissions.

- Measuring GHG emissions: to minimise inconsistencies with entities reporting under the NGER Scheme, the AASB proposes that an entity is required to prioritise applying NGER Scheme methodologies in measuring its GHG emissions before referring to other GHG measurement methods or frameworks.

- CO2 measurement: IFRS S2 necessitates the conversion of greenhouse gases into a CO2 equivalent utilising the latest global warming potential (GWP) values issued by the Intergovernmental Panel on Climate Change (IPCC) – which would be its 6th Assessment Report (AR6). To avoid potential inconsistencies with the NGER Scheme, the AASB proposes that entities use GMP values from the IPCC’s 5th Assessment Report (AR5).

- Scope 2 GHG emissions: there are two ways to quantify Scope 2 GHG emissions – location-based method and market-based method. Location-based method quantifies GHG emissions based on average energy generation emission factors for defined locations, including local, subnational, or national boundaries.

Whereas market-based method quantifies GHG emissions emitted by the generators from which the reporter contractually purchases electricity. IFRS S2 only requires an entity to disclose its location-based Scope 2 GHG emissions.

The AASB proposes that an entity should also disclose its market-based Scope 2 GHG emissions, when applicable, in addition to its location-based Scope 2 GHG emissions, except for the first three annual reporting periods in which an entity applies ASRS 2.

- Scope 3 GHG emissions: IFRS S2 requires an entity to disclose its Scope 3 GHG emissions and consider its entire value chain (upstream and downstream), as well as all 15 categories of Scope 3 GHG emissions as described in the Greenhouse Gas Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard (2011).

The AASB proposes to add the 15 Scope 3 GHG emission categories in IFRS S2 to ASRS 2 as examples of categories that an entity could consider when disclosing the sources of its Scope 3 GHG emissions, rather than requiring an entity to categorise the sources of emissions in accordance with the 15 categories described by IFRS S2.

- Describing not material climate impacts: entities which determine that climate-related risks and opportunities are not material to its operations and prospects are required to disclose that fact and explain how it came to that conclusion in its general-purpose financial report.

- Executive remuneration and climate considerations: IFRS S2 requires disclosure of:

a) Whether and how climate-related considerations are factored into executive remuneration; and

b) The percentage of executive management remuneration recognised in the current period that is linked to climate-related considerations.

For the purposes of this disclosure, the AASB clarified that ‘executive’ and ‘executive management’ have the same meaning as ‘key management personnel’, and ‘remuneration’ has the same meaning as ‘compensation’, both as defined in AASB 124 Related Party Disclosures.

- Carbon credits clarification: IFRS S2 requires an entity to describe its planned use of carbon credits and demonstrate the extent to which these carbon credits are relied on to achieve its net greenhouse gas emissions targets.

There are two forms of Australian Carbon Credit Units (ACCUs) issued under the Australian Carbon Credit Unit Scheme: Kyoto ACCUs and non-Kyoto ACCUs.

The AASB proposes to amend the definition of a carbon credit to ensure that both Kyoto ACCUs and non-Kyoto ACCUs can be reported as carbon credits in the context of ASRS 2.

- Omission of reference to SASB standards: the AASB proposes to remove references to Sustainability Accounting Standards Board (SASB)’s Standards and sector-based metrics adapted from those Standards on the basis that they do not adequately represent the Australian market.

Nevertheless, entities wishing to make voluntary disclosures using SASB Standards will retain the option to do so.

In that case, the AASB proposes a requirement for entities that elect to make sector-based disclosures to take into consideration well-established and widely understood metrics associated with particular business models, activities, or other common features found in the same sector, as classified using the Australian and New Zealand Standard Industrial Classification (ANZSIC).

- Enhanced presentation flexibility: rather than mandating a form of disclosure, the AASB proposes that entities exercise judgement in presenting information in a way that facilitates users in locating their climate-related financial disclosures in a general-purpose financial report.

- Financed emissions consideration: whilst IFRS S2 required entities that participate in financial services such as asset management, commercial banking, and insurance to disclose its financed emissions, the AASB proposed that Australian entities should ‘consider’ the applicability of those disclosures rather than requiring them to do so.

What is not changing?

The proposed Australian standards would still require an

entity to:

- Disclose material information about its climate-related risks and opportunities (whether physical risks or transition risks) that could reasonably be expected to affect the entity’s cash flows, access to finance or cost of capital, and its ability to further its objectives, over the short, medium or long term.

- Disclose material information about the climate-related risks and opportunities that could reasonably be expected to affect the entity’s prospects.

- Determine its climate-related financial disclosures on the same entity basis as its related financial statements (i.e., on an individual entity or consolidated entity basis, and including any joint ventures and associates).

- Provide disclosures about the entity’s governance, strategy, and risk management relating to climate-related risks and opportunities and its metrics and targets adopted.

Who will the proposal affect and when?

The exposure draft does not specify which entities the proposals would apply to or when those proposals would apply.

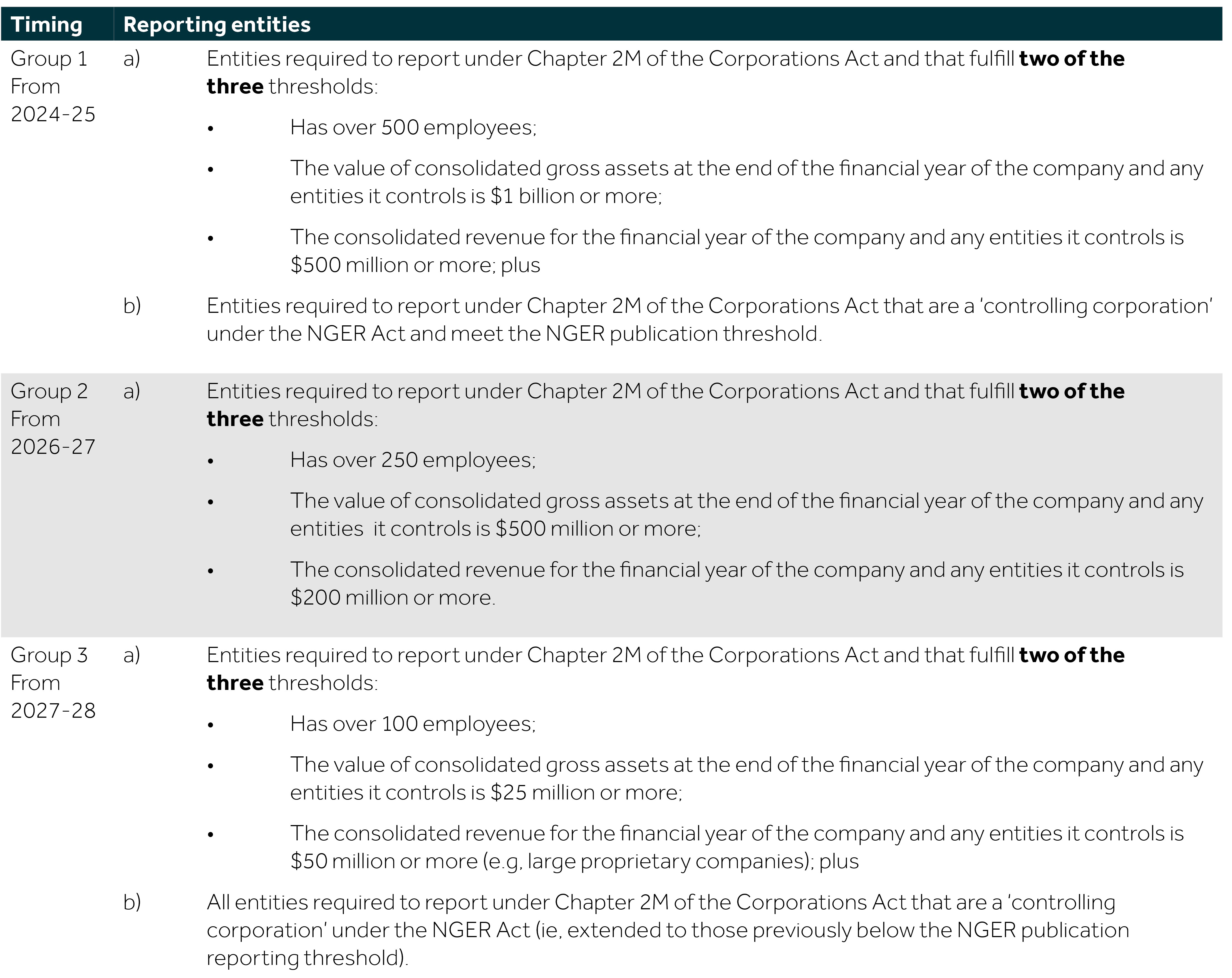

The Australian Government has committed to implementing the reporting of climate-related financial information commencing from the 2024-25 financial year. Treasury set out its proposals for which entities should mandatory report climate disclosures and the timetable for implementing such disclosures in its Second Consultation Paper as:

Charities registered under the Australian Charities and Not-for-Profits Commission Act 2012 would not be caught within the above definitions, unless subject to the NGER Act. However, it is possible that other not-for-profit companies, such as companies limited by guarantee, could satisfy the size tests above and be required to apply ASRS standards.

While 2023 marked a significant milestone for sustainability reporting, 2024 promises even greater impact as the AASB and Treasury finalise their proposals and companies start their journey to mandatory climate-related financial reporting.

Speak with your local Nexia Adviser today to see how we can help you unlock your true potential or if you have any questions about anything mentioned in this article.