Bill on three new measures affecting small businesses

What happened?

Recently, Treasury released a Bill1 that has the potential, once / if it is enacted, to shake up the business landscape in which small businesses operate.

In broad terms, if you are conducting a business2 that has an aggregated turnover3 of less than $10 million, the following proposed changes may be relevant for

you in the 2017 income tax year (i.e., for income years commencing 1 July 2016):

- an increase to the small business entity threshold to $10 million aggregated turnover (up from $2 million in 2016) – entitling you to a whole raft of tax concessions set out in the table below;

- a reduction in the corporate tax rate to 27.5 per cent4; and

- an increase to the unincorporated small business tax discount from 5 per cent to 8 per cent (provided your unincorporated entity has an aggregated turnover of less than $5 million) – however, the amount of the offset will remain capped at $1,000 per year per individual.

Note however that the thresholds for the small business CGT concessions (i.e., $2 million aggregated turnover test5 and $6m net asset value test) will remain the same.

What do these proposed changes mean for you in the 2017 income tax year?

1. Increase of small business entity threshold to $10 million (up from $2 million in 2016)

This proposed increase means that a business (whether incorporated or not) with less than $10 million in aggregated turnover will qualify for the following concessions6 that are currently only available for businesses turning over less than $2 million:

- $20,000 immediate asset write-off (e.g., immediate deduction if buy and install depreciating asset costing less than $20,000)

- Immediate deduction for start-up costs

- Immediate deduction for certain prepaid expenses

- Simplified depreciation rules (e.g., small business pooling rules)

- Simplified trading stock rules (e.g., avoid end of year stocktake if value of the stock has changed by less than $5,000)

- Simplified PAYG rules (e.g., ATO to calculate PAYG instalments)

- Accounting for GST on cash basis, paying GST by quarterly instalments and annual apportionment for input tax credits for acquisitions that are partly creditable

- Immediate deduction for certain prepaid expenses

- FBT car parking exemption (from 1 April 2017) and ability for employees to salary- sacrifice two identical portable electronic devices such as laptops (from 1 April 2016)

- Small businesses restructure rollover (applicable from 1 July 2016)

The Bill confirms that the small business restructure rollover – that is, a rollover whereby small businesses can transfer assets without any tax consequences between different types of entities – will be available for entities with an aggregated turnover below $10 million7.

Franking treatment change

2. Reduction in corporate tax rate

2a Effect on 2017 income tax year

The proposed reduction in the corporate tax rate also affects the way dividends will be franked for tax purposes.

From 1 July 2016, the maximum franking credit available on a dividend will be based on the rate of tax paid by the company making the distribution8 (and for the 2017 income tax year that rate will be determined by the amount of the aggregated turnover of the company in 2016).

Practically this means that for the 2017 income tax year, the maximum franking credit will be:

- 30 per cent if the company’s aggregated turnover for the 2016 income tax year (i.e., the previous year) is equal to or exceeds $10 million; or

- 27.5 per cent if the company’s aggregated turnover for the 2016 income tax year (i.e., the previous year) is less than $10 million.

This is a departure from the franking treatment that applied in the 2016 income tax year9 (where, even if a company paid tax at the 28.5 per cent rate, the franking credit was still worked out at the corporate tax rate of 30 per cent).

This treatment may also result in unused franking credits and potential tax imposts of more than 50 per cent10.

Gradual lowering of corporate tax rate over time

2b Effect on later income tax years

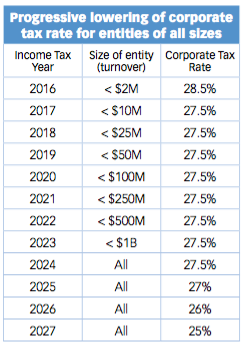

This lower corporate tax rate of 27.5 per cent will be progressively extended to all corporate taxpayers by the 2024 income tax year and then further reduced to 25 per cent for all corporate taxpayers by the 2027 income tax year.

The Government believes that by lowering the corporate tax rate, Australia will become a more attractive destination for foreign capital.

3. Increase of unincorporated small business tax discount to 8 per cent (up from 5 per cent in 2016)

This proposed increase in the discount percentage from 5 per cent in 2016 to 8 per cent in 2017 (and eventually to 13 per cent by 2026) is welcomed. However, since the amount of offset will remain capped at $1,000 per individual per year for unincorporated businesses (e.g.,sole traders, trusts or partnerships) with aggregated turnover of less than $5 million, unfortunately the benefit of this offset is not that big.

Therefore, this $1,000 cap may actually serve as in incentive for business owners to consider whether it would be better to incorporate their structure – not only because of the reduced corporate tax rate, but also because such a restructure should now potentially be easier using the small business restructure rollover that applies from 1 July 2016.

How can Nexia help you?

The Government hopes that by lowering the corporate tax rate and implementing these small business changes it will encourage investment, enhance productivity, increase the level of economic activity and over time increase real wages.

However, it is important to keep your wits about you when determining what threshold applies to your specific situation.

For example, an unincorporated entity with aggregated turnover of say $8 million will not qualify for the unincorporated small business tax discount (capped at $1,000) because it does not have aggregated turnover of less than $5 million. However, if such an unincorporated entity has bought assets costing less than $20,000 in the 2017 income tax year, the unincorporated entity would be entitled to the $20,000 instant asset write-off (as threshold for this test is $10 million).

Furthermore, it will become more important to manage the extraction of dividends from a company.

Please speak to your Nexia Advisor if you would like to discuss anything mentioned in this article or if you would like us to perform a financial health check on your business. Also, with the potential to restructure your business tax free (i.e., with the small business restructure rollover), it may be prudent to reconsider whether your operating structure (e.g., whether the business is operated through a company, trust, partnership or as a sole trader) is still ideal for your particular circumstances.

We look forward to assisting you in claiming these small business incentives to assist you in growing your business.

- Treasury Laws Amendment (Enterprise Tax Plan) Bill 2016, 1 September 2016

- A business includes any profession, trade, employment, vocation or calling but does not include occupation as an employee [s995-1 of the Income Tax Assessment Act 1997 (ITAA 1997)]

- Aggregated turnover is broadly the sum of the turnover of the entity, its associates and entities connected with the entity [s995-1 of the ITAA 1997]

- The 2016 corporate tax rate was 30% for companies with an aggregated turnover of more than $2 million (regardless of whether the company was carrying on a business) and 28.5% for companies with an aggregated turnover of less than $2 million (only if the company was carrying on a business).

- This will be done by replacing references in the small business CGT legislation to a “small business entity” with references to a “CGT small business entity”.

- Most of these concessions are found in s328-10(1) of the ITAA 1997

- This certainty is welcomed since from reading the 2016 Federal Budget proposals dealing with this measure, it was uncertain whether the threshold for this kind of rollover would remain at $2 million or increase to $10 million.

- Paragraph 4.19 of the Explanatory Memorandum to the Treasury Laws Amendment (Enterprise Tax Plan) Bill 2016

- Paragraph 1.68 of the Explanatory Memorandum to the Treasury Laws Amendment (Enterprise Tax Plan) Bill 2016

- This also happened in the early 2000s when the company tax rate was reduced from 36% to 30%.