In the war for talent, businesses are considering incentives on top of wages to hire and retain the best people. However, going down that path can lead to additional taxation costs in the form of FBT implications. The FBT could cost the business considerably more than if these additional benefits were offered as extra salary in the form of grossed up wages. If you have already offered staff incentives on top of wages in the form of non-cash benefits, we can help you to understand whether FBT will apply to those benefits.

The following are examples of benefits that could potentially incur FBT:

- Allowing an employee to use a work car, including a dual cab ute, for private purposes;

- Providing employees with car parking;

- Gym memberships;

- Tickets to concerts, shows or sports events;

- Reimbursing school fees;

- Providing discounted loans; and

- Salary sacrifice arrangements with employees.

FBT can be a complicated tax, there are many misconceptions leading to innocent mistakes being made by businesses. In our experience, these include assuming car benefits are exempt when they are not, misunderstanding what qualifies as entertainment and the need to correctly account for the expenses when it comes to claiming GST credits.

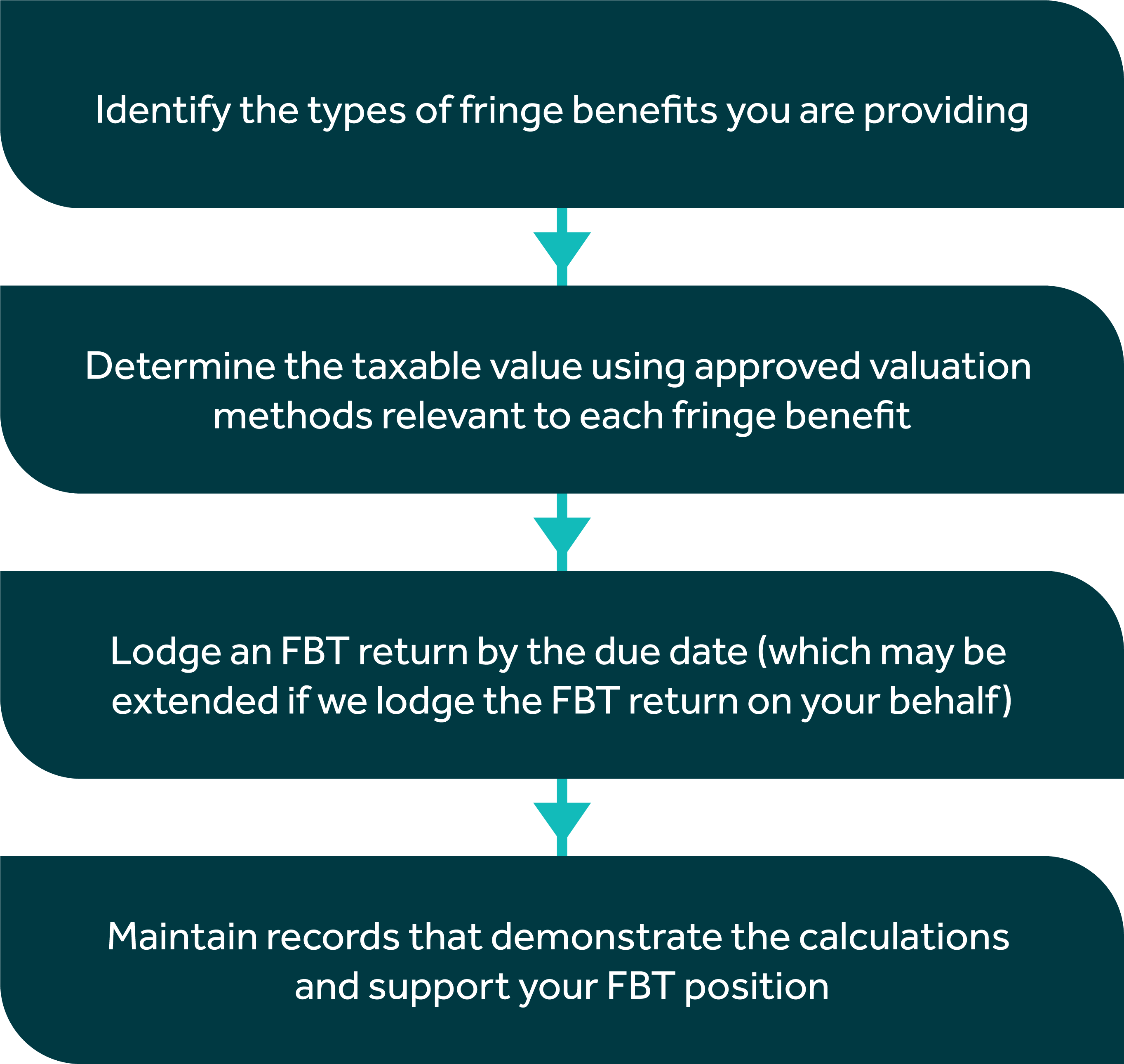

We can advise you on the following steps:

At Nexia, we can assist you in understanding how the above benefits are treated for FBT, as well as advising on how best to structure employee incentives going forward and/or advise on the taxation implications to allow you to be aware of the additional on-costs that could be triggered by providing these staff incentives.

This update was provided by Sydney's Business Advisory Partner Katie Lin.