We are happy to present our quarterly review of the mid-market IPOs on the ASX.

We are happy to present our quarterly review of the mid-market Initial Public Offerings (“IPOs”) on the Australian Securities Exchange (“ASX”). The focus of the analysis is on the current quarter and the immediately preceding 12 months with the aim of providing you with an overview of the current mid-market IPO activity.

In our analysis, we have looked at IPOs with an enterprise value of less than $200 million at the time of listing. We have also provided some further detail on the cost of IPOs broken down by market capitalisation, and the performance of IPOs occurring in the last 12 months by significant sectors.

Key highlights are:

- There were 7 mid-market IPOs in the quarter, an increase from last quarter and the same quarter last year.

- The mining-related sectors remained the most active sector in the quarter with 3 IPOs.

- Mid-market companies aggregately raised $446.2 million on the ASX in the quarter, compared to $15.3 million during the last quarter.

- The average IPO fundraising was $63.7 million, which increased c.$58 million on the previous quarter, and a 127.9% increase on the 12-month average.

- On average, transaction costs (excluding brokerage fees) for the last 12 months increased by 85.7% to $0.40 million when compared to the prior year.

Overview

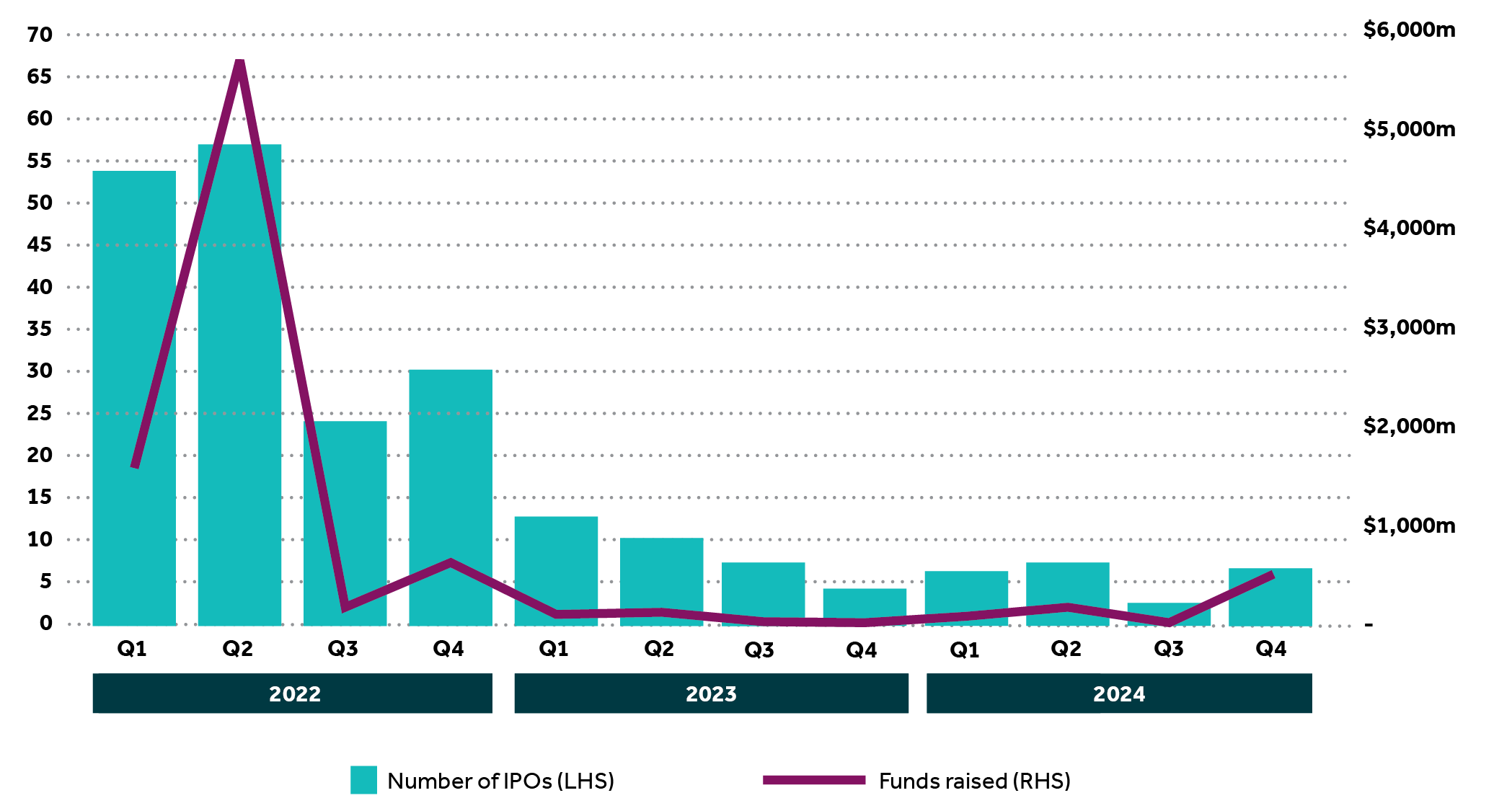

There were 7 IPOs in the mid-market this quarter, an increase from 3 last quarter and an increase compared to the same quarter last year (Q4 2023) which had 4.

Total funds raised in the quarter was $446.2 million, a $430.9 million increase from last quarter, and a $414.7 million increase compared to the same quarter last year.

The average funds raised per transaction this quarter was 12 times as much as last quarter, increasing from $5.1 million last quarter to $63.7 million, and a 707.9% increase compared to the same quarter last year. The large increase in funds raised in the quarter is primarily due to the listing of Guzman y Gomez Limited, which raised $335.1 million (75.1% of total funds raised). Such a large amount of funds raised increased the average funds raised per transaction in the quarter.

This quarter has seen the 12-month average funds raised per transaction increase by 127.9%.

The average enterprise value at IPO in the quarter was $495.4 million, which was 40 times more than last quarter and 20 times more than the same quarter last year. This increase is attributed to Guzman y Gomez’s substantial valuation at $3,040.9 million, which represented 88% of the total value of all companies listed in the quarter.

Source: S&P Capital IQ and Nexia analysis

Quarterly Activity

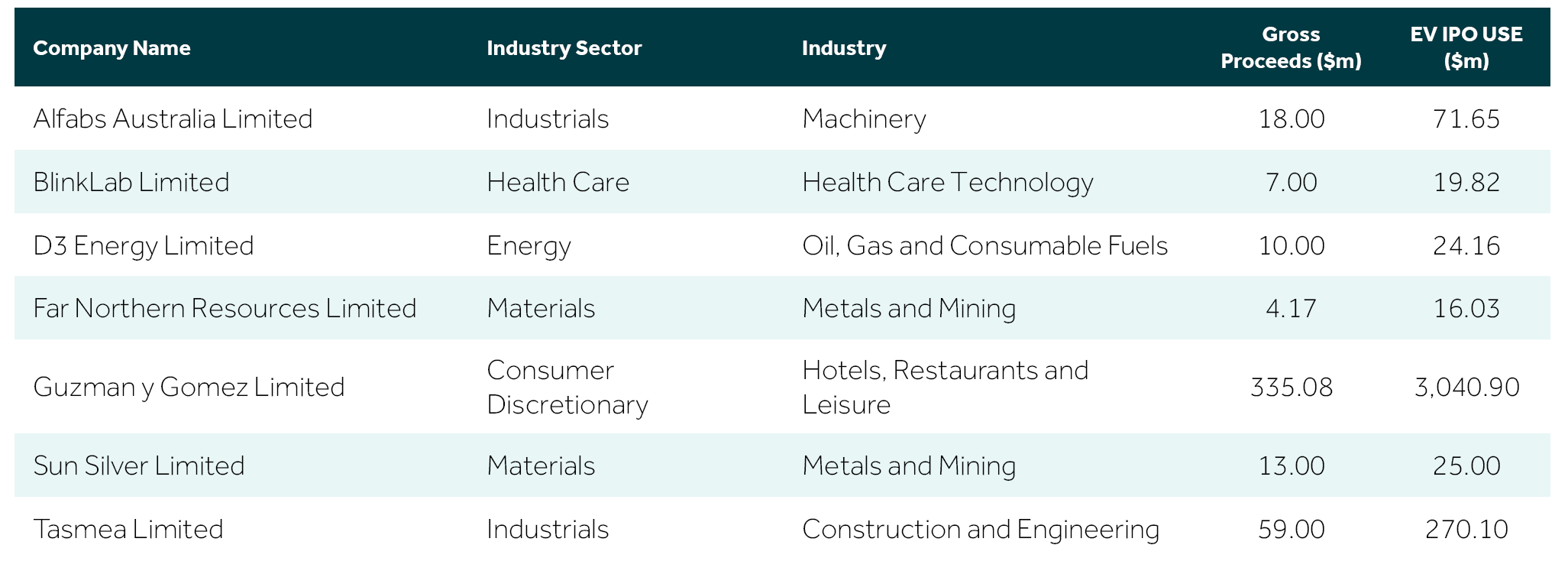

During the quarter, 3 IPOs were within mining-related sectors, while the remaining IPOs were within the industrials, consumer discretionary and healthcare sectors.

Source: S&P Capital IQ and Nexia analysis

Transaction Costs

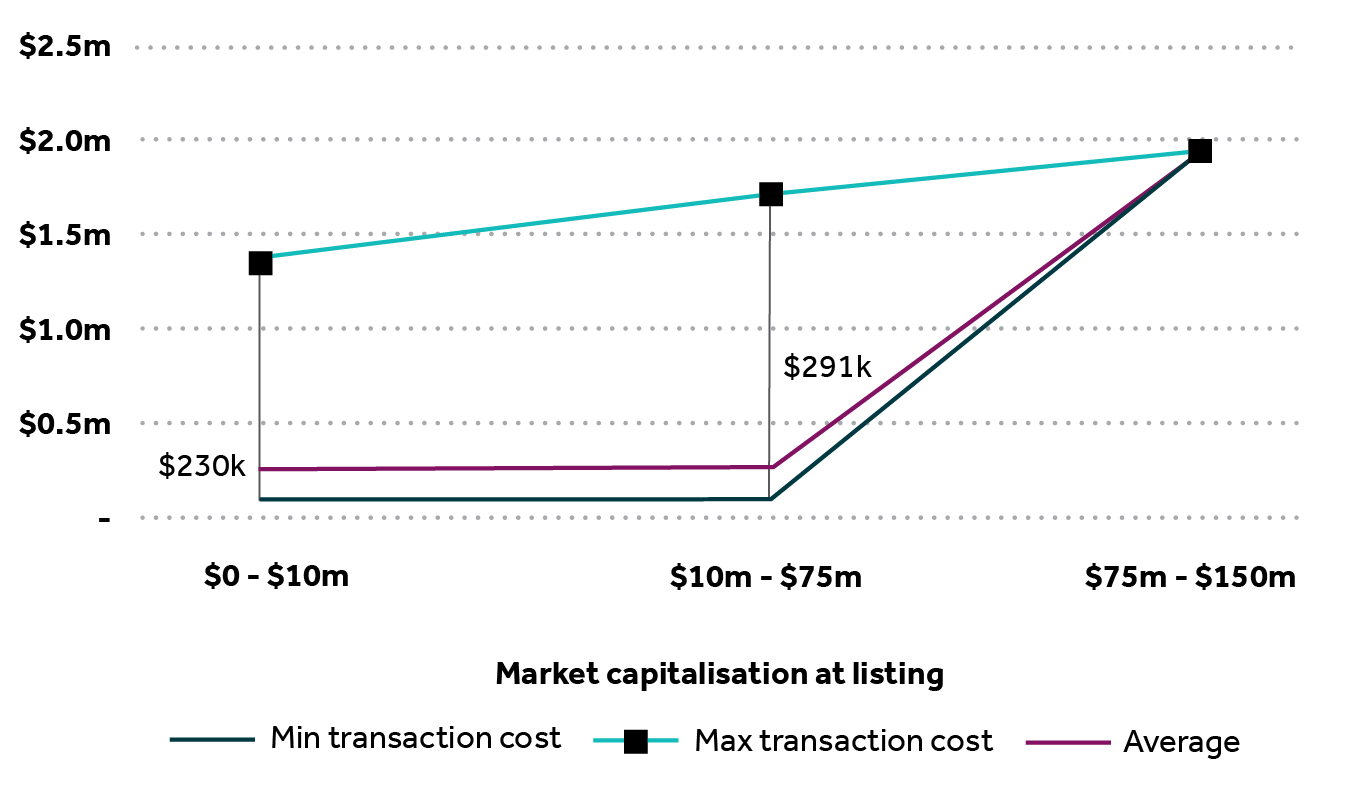

Certain costs in undertaking an IPO, being accounting and legal costs, are typically fixed regardless of the outcome. Fundraising costs, on the other hand, are generally paid on successful completion of the IPO and represent a percentage of proceeds raised. Accordingly, fundraising costs have been excluded from our analysis.

A number of factors will impact the costs incurred, including how prepared the company is for the IPO, the complexity of its business and whether there are any related transactions. Average fixed costs per IPO were higher in the last twelve months compared to the previous year, increasing from $213,881 to $397,174.

Methodology

This analysis has been prepared based on data sourced from S&P Capital IQ. Data analysed is for completed IPOs on the ASX, from 1 April 2024 to 30 June 2024, with an implied enterprise value of less than $200 million. If no implied enterprise value was disclosed at the IPO filling date, transactions were adjusted to reflect the first enterprise value disclosed within the preceding 90 days.

Of the seven transactions analysed for transaction costs, there was sufficient data for all of the transactions to calculate the average accounting fees per transaction and there was sufficient data for all of the transactions to calculate the average legal fees per transaction.